As Hong Kong strengthens its position as an international financial hub, its efficient and transparent financial environment attracts numerous enterprises. However, financial management and tax compliance in Hong Kong present significant challenges for both local and multinational companies. Against this backdrop, Accounts Payable (AP) automation not only enhances operational efficiency but also helps enterprises navigate Hong Kong’s unique financial policies and regulations.

Understanding Hong Kong Invoice Policies

As a key economic center in the Asia-Pacific region, Hong Kong’s invoice policies feature the following distinct characteristics:

Understanding Hong Kong Invoice Policies

As a key economic center in the Asia-Pacific region, Hong Kong’s invoice policies feature the following distinct characteristics:Uses of Invoices

- Bookkeeping: Invoices serve as essential documentation for recording business transactions.

- Supplier Reconciliation: Businesses can reconcile transaction details with suppliers to ensure accurate payments.

- Customs Clearance: While Hong Kong operates as a free port with duty-free imports and exports, invoices are still mandatory for customs declarations.

- Tax Reporting: Although Hong Kong does not have a Value-Added Tax (VAT), accurate invoice records are fundamental for profit tax reporting under the Inland Revenue Ordinance.

Invoice System

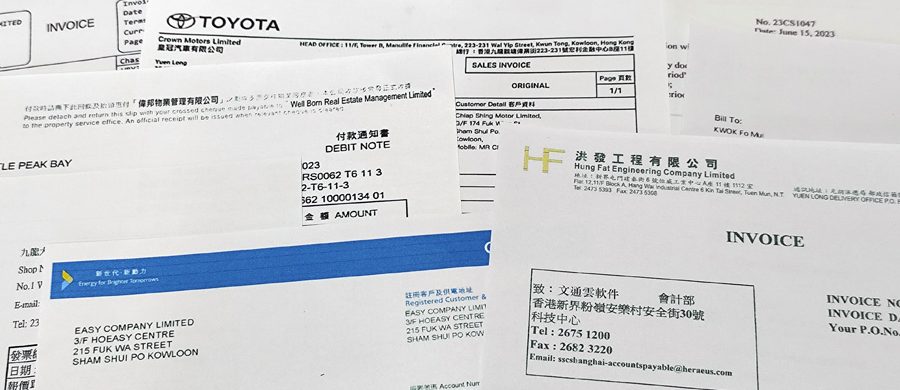

- Hong Kong does not implement a unified VAT invoice system. Invoice formats and contents can be customized by businesses but must include basic details such as supplier names, transaction amounts, and dates.

- While e-invoices are gaining popularity, businesses must retain physical records for audit purposes for a defined period.

Compliance and Legitimacy

- The Inland Revenue Department (IRD) mandates accurate and valid invoices as the foundation for profit tax filings. Ensuring invoice authenticity is crucial for lawful business operations.

- Under anti-money laundering (AML) and anti-corruption regulations, businesses must subject invoices for significant transactions to stricter compliance checks.

Key focus areas of the accounts payable

1. Improved Invoice Processing Efficiency

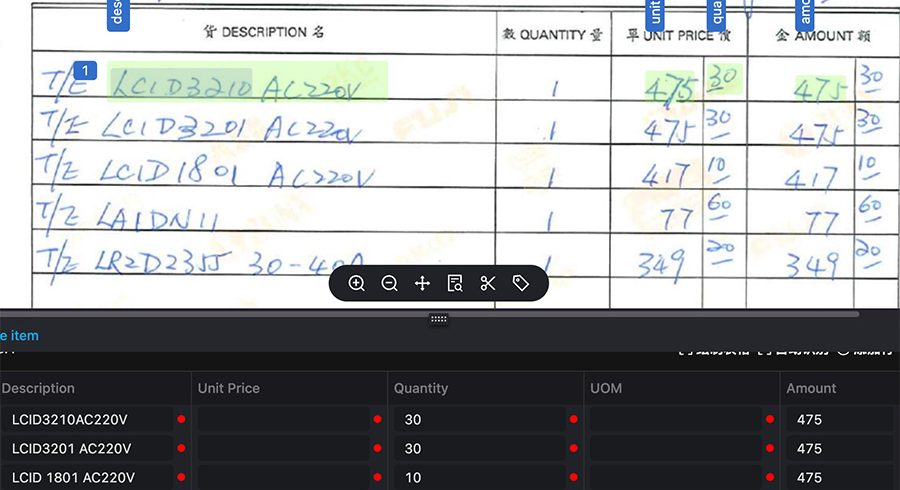

Traditional invoice processing often depends on manual efforts, which can result in errors and an increased risk of duplicate payments. Automation tools enable the swift extraction of invoice data for batch processing, significantly reducing errors caused by manual entry. Leveraging advanced AI technology not only enhances data entry efficiency and reduces time costs but also, through NLP capabilities, performs reconciliation tasks that previously required experienced financial professionals.2. Compliance Checks and Risk Control

Automation systems perform real-time compliance checks aligned with IRD requirements, such as verifying transaction legitimacy and mitigating risks of fraudulent invoices. With embedded intelligent analytics frameworks, these systems detect potential duplicate payments, non-compliant records, and other anomalies.3. Simplified Supplier Reconciliation and Tax Reporting

AP systems automatically reconcile supplier statements with internal invoice records, identifying outstanding accounts swiftly.Limitations of Traditional Solutions

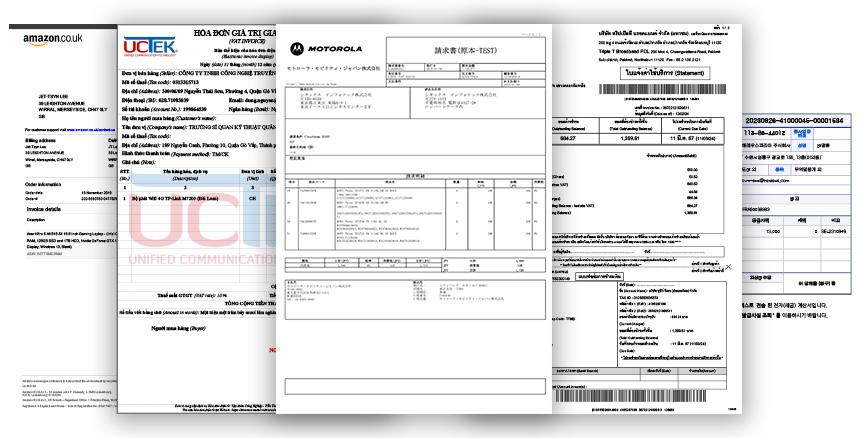

In a complex invoice processing landscape like Hong Kong, traditional solutions underperform in efficiency and cost control. Examples include:

ABBYY Vantage

Despite its global reputation, ABBYY Vantage struggles with bilingual text processing, resulting in higher error rates when handling Hong Kong’s unique dual-language invoices.OpenText VIM

Integrated with SAP, OpenText VIM involves high deployment and maintenance costs, making it less feasible for small- to medium-sized enterprises. Additionally, its limited support for localized needs fails to adapt to Hong Kong’s diverse invoice formats effectively.Advantages of Wentong

As a provider of intelligent document processing (IDP) solutions, Wentong cloud offers significant advantages in AP automation.

Robust Language Support

Optimized for the multilingual environment of the Asia-Pacific region, the system delivers high accuracy in processing documents with mixed Chinese and English content.Flexible Configuration and Adaptive Learning

The platform supports lightweight deployment with minimal customization. It adjusts rules on demand, catering to Hong Kong’s dynamic business environment.Value-Added Services

Supplementary manual review services ensure the accuracy of critical data, especially for stringent compliance scenarios.Seamless ERP Integration

Wentong.cloud’s solutions integrate seamlessly with leading ERP systems like SAP and Oracle, enabling comprehensive automation workflows.