In today’s fast-paced business environment, manual Accounts Receivable (AR) processes are increasingly becoming obsolete. Traditional methods, plagued by inefficiencies, high error rates, and resource-intensive tasks, are unsustainable for businesses aiming to scale. Enter AR Automation—a transformative solution powered by advanced AI technologies that is redefining financial operations.

The AR Automation Revolution: More Than Just Efficiency

AR Automation is not merely about streamlining workflows; it is about reimagining the entire AR ecosystem. By leveraging sophisticated AI and machine learning algorithms, businesses can achieve:

1. Up to 80% reduction in processing times

2. Over 90% decrease in errors

3. 30% faster collections, improving cash flow

4. Up to 40% of the finance team’s time freed for strategic tasks

These benefits illustrate how AI is expanding the possibilities within AR Automation.

How AR Automation Works

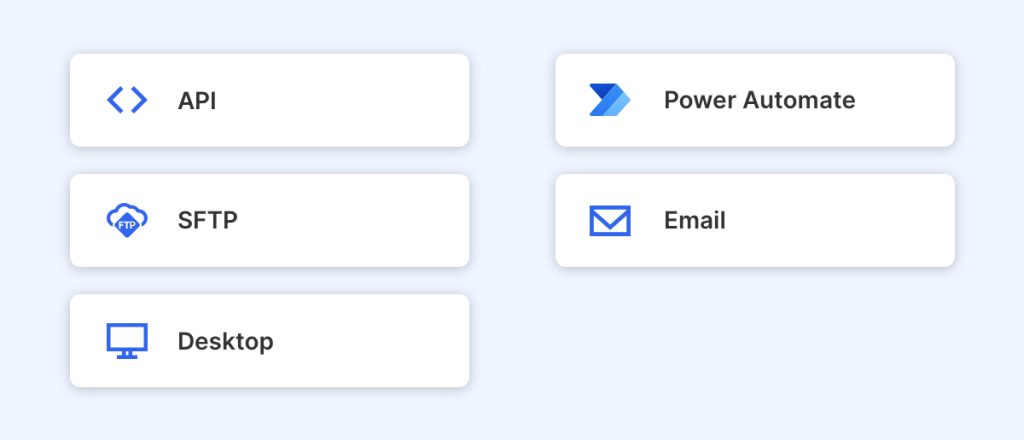

1. Document Ingestion

- API Integrations: Seamlessly connecting with ERP systems or other platforms.

- Power Automate Workflows: Automating input from diverse business applications.

- Email & SFTP: Automatically retrieving documents from email attachments or secure file transfer protocols.

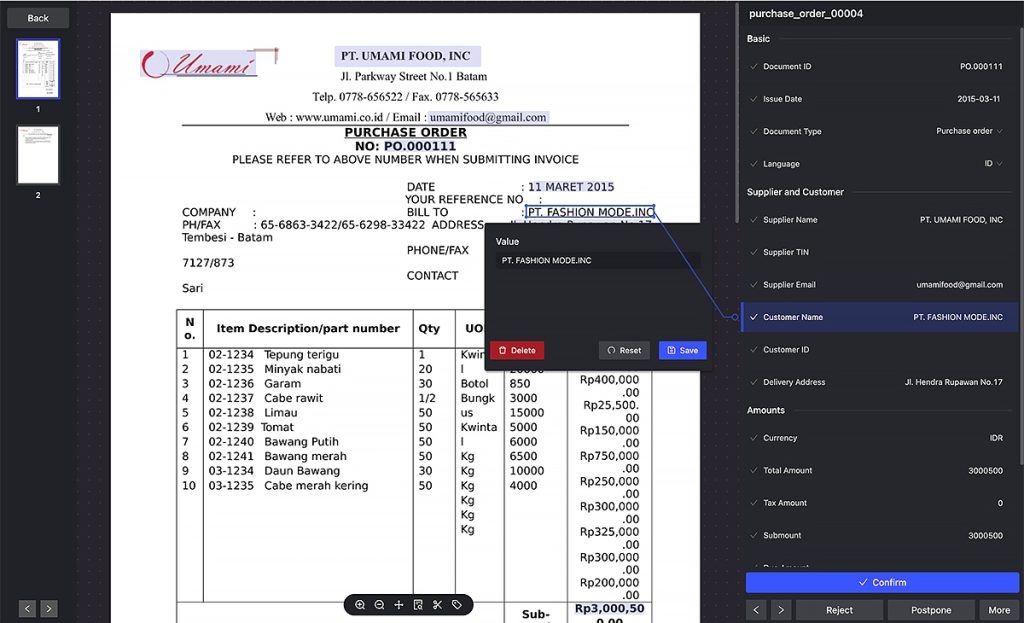

2. AI Model Data Extraction

- Automate Data Extraction: Employ AI models configured to handle various document types, regardless of format or source (e.g., emails, EDI, procurement systems).

- Download & Route Files: Automatically fetch and process documents from connected channels, eliminating delays and manual effort.

3. Validation and Human-in-the-Loop

- Adaptive Data Capture: Mimics human-like reading abilities, dynamically adjusting to different styles and formats of documents.

- Policy Compliance Automation: Processes extracted data according to pre-set business rules, minimizing risks of deviation.

- Confidence Thresholds: Triggers human review if AI-generated data confidence is low, with the system learning from each human interaction to improve over time.

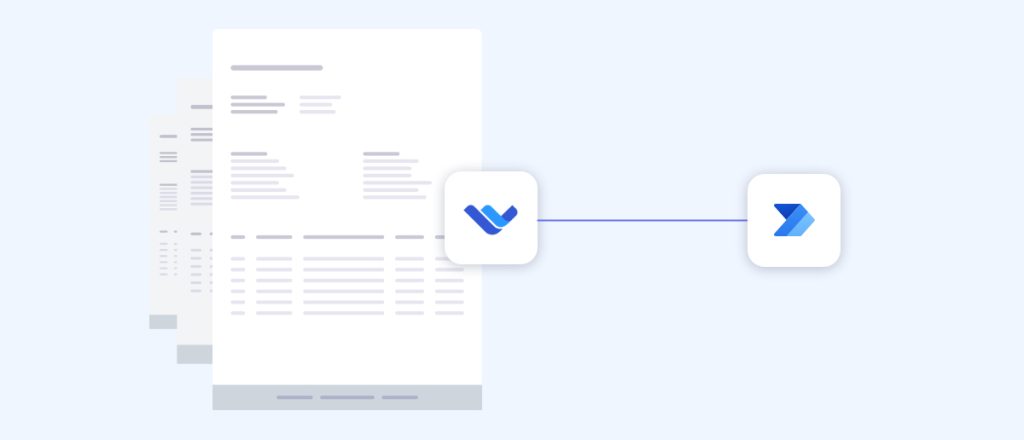

4. Seamless Output Integration

Once validated, the processed data can be seamlessly exported to desired destinations, such as:

Power Automate: Automating downstream workflows, like updating financial ledgers or notifying relevant teams.

ERP Systems: Ensuring real-time synchronization and error-free data entry into platforms like SAP, providing a smooth and integrated financial ecosystem.

AR Automation in Action

- Computer Vision AI: Recognizes and interprets complex document layouts, including handwritten notes, enhancing the system’s ability to process diverse document types.

- Natural Language Processing (NLP): Understands context and intent within unstructured text, enabling more accurate data extraction and interpretation.

- Adaptive Learning Algorithms: Continuously improve the system’s accuracy with each processed document, ensuring that the IDP system becomes more efficient over time.